You, disabled? What are your chances?

The chances of disability? Higher than you probably think. You can ignore the problem, but it’s hard to ignore the facts:

- Just over 1 in 4 of today’s 20 year-olds will become disabled before they retire.

- Accidents are NOT usually the culprit. Back injuries, cancer, heart disease and other illnesses cause the majority of long-term absences.

Are you prepared if it happens to you? Probably not. If you’re like most Americans, you don’t have disability insurance. Or enough emergency savings to last 34.6 months. Yes, that’s the duration of the average long-term disability claim.

If you become disabled, will you be ready? Or will you and your loved ones face serious financial hardship, possibly foreclosure and even bankruptcy? Good news. The Council for Disability Awareness can help you prepare for disability the same way you plan for other emergencies. Here’s how.

What are the most common causes of disability?

Injuries at work? Freak accidents? It’s true, they happen. But the truth might surprise you.

- Illnesses like cancer, heart attack or diabetes cause the majority of long-term disabilities. Back pain, injuries, and arthritis are also significant causes.

- Most are not work-related, and therefore not covered by workers’ compensation.

- Lifestyle choices and personal behavior that lead to obesity are becoming major contributing factors.

- Musculoskeletal disorders are the #1 cause of disabilities. Examples include; arthritis, back pain, spine/joint disorders, fibromytis, etc.

- Here is a chart of claim diagnosis categories in lay language to provide clear examples of common causes of disability.

Disability in America

Disability is already a widespread problem, and the threat is growing at an alarming rate.

- More than 30 million Americans between the ages of 21 and 64 are disabled, according to the most recent U.S. Census.

- 2.3 million people filed disability claims with Social Security in 2008.

- 25+ million American lives are restricted by the effects of disability, according to the Centers for Disease Control and Prevention.

Here’s how you can reduce your chances of becoming disabled.

Disability statistics

This page was last updated on July 3rd, 2013

It happens more often than you'd imagine:

- Just over 1 in 4 of today's 20 year-olds will become disabled before they retire.

- Over 37 million Americans are classified as disabled; about 12% of the total population. More than 50% of those disabled Americans are in their working years, from 18-64.

- 8.8 million disabled wage earners, over 5% of U.S. workers, were receiving Social Security Disability (SSDI) benefits at the end of 2012.

- In December of 2012, there were over 2.5 million disabled workers in their 20s, 30s, and 40s receiving SSDI benefits.

- A typical female, age 35, 5’4", 125 pounds, non-smoker, who works mostly an office job, with some outdoor physical responsibilities, and who leads a healthy lifestyle has the following risks:

- A 24% chance of becoming disabled for 3 months or longer during her working career;

- with a 38% chance that the disability would last 5 years or longer,

- and with the average disability for someone like her lasting 82 months.

- If this same person used tobacco and weighed 160 pounds, the risk would increase to a 41% chance of becoming disabled for 3 months or longer.

- A typical male, age 35, 5’10", 170 pounds, non-smoker, who works an office job, with some outdoor physical responsibilities, and who leads a healthy lifestyle has the following risks:

- A 21% chance of becoming disabled for 3 months or longer during his working career;

- If this same person used tobacco and weighed 210 pounds, the risk would increase to a 45% chance of becoming disabled for 3 months or longer.

- There were over 2.8 million new Social Security Disability Insurance (SSDI) applications in 2012, slightly lower than in the two previous years, but still 29% higher than in 2007, and 67% higher than 2002 levels.

- 61% of surveyed wage earners personally know someone who has been disabled and unable to work for 3 months or longer.

- Wage earners who know someone who has been disabled predict their own odds to be higher than respondents who do not.

- The average group long-term disability claim lasts 34.6 months.

- The average individual disability claim lasts 31.6 months.

- One in eight workers will be disabled for five years or more during their working careers.

- 64% of wage earners believe they have a 2% or less chance of being disabled for 3 months or more during their working career.5 The actual odds for a worker entering the workforce today are about 25%.

- Most working Americans estimate that their own chances of experiencing a long term disability are substantially lower than the average worker’s.

- 90% of wage earners rated their "ability to earn an income" as "valuable" or "very valuable" in helping them achieve long-term financial security — wage earners perceive their ability to earn an income as even more valuable than retirement savings, medical insurance, personal possessions, other forms of savings or their homes.

- Medical problems contributed to 62%9 of all personal bankruptcies filed in the U.S. in 2007- an estimate of over 500,000.10 This is a 50% increase over results from a similar 2001 study.

- Medical problems contributed to half of all home foreclosure filings in 2006.

- According to CDA's 2013 Long-Term Disability Claims Review12, the following were the leading causes of new disability claims in 2012:

- Musculoskeletal/connective tissue disorders (28.5%)

- Cancer (14.6%)

- Injuries and poisoning (10.6%)

- Mental disorders (8.9%)

- Cardiovascular/circulatory disorders (8.2%)

- The most common causes of existing disability claims in 2012 were:

- Musculoskeletal/connective tissue disorders (30.7%)

- Disorders of the nervous system and sense organs (14.2%)

- Cardiovascular/circulatory disorders (12.1%)

- Cancer (9.0%)

- Mental disorders (7.7%)

- Approximately 90% of disabilities are caused by illnesses rather than accidents.

- Do you save any of your annual income? 48% of U.S. families don't.

- Retirement savings? One-third of us have none.

- 68% of adult Americans have NO savings earmarked for emergencies.

- 65% of working Americans say they could not cover normal living expenses even for a year if their employment income was lost; 38% could not pay their bills for more than 3 months.

- Nearly nine in ten workers (86%) surveyed believe that people should plan in their 20’s or 30’s in case an income limiting disability should occur;

- Only half (50%) of all workers have actually planned for this possibility.

- Fewer than half (46%) have even discussed disability planning.

- About 100 million workers are without private disability income insurance.

- 69% of workers in the private sector have no private long-term disability insurance.

Chances of becoming disabled:

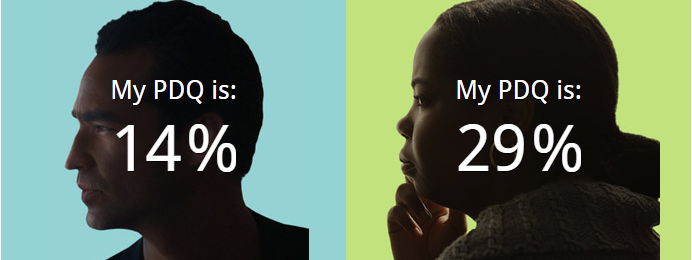

The following statistics come from CDA’s PDQ disability risk calculator:

A sample of factors that increase the risk of disability: Excess body weight, tobacco use, high risk activities or behaviors, chronic conditions such as; diabetes, high blood pressure, back pain, anxiety or depression, frequent alcohol consumption or substance abuse.

A sample of factors that decrease the risk of disability: Maintaining a healthy body weight, no tobacco use, healthy diet and sleep habits, regular exercise, moderate to no alcohol consumption, avoidance of high risk behaviors including substance abuse, maintaining a healthy stress level, and effective treatment of chronic health conditions.

To calculate your own Personal Disability Quotient (PDQ), go to:

To learn more about risk factors and ways to help reduce your risk, go to:

Disability prevents people from earning a living:

Working Americans underestimate their risk of disability:

Disability causes severe financial hardship:

Common causes of disability:

* This category includes claims caused by neck and back pain; joint, muscle and tendon disorders; foot, ankle and hand disorders, etc.

Few American workers are financially prepared:

How long could you afford to be without a paycheck?

Most American workers’ incomes are not protected:

Think Social Security or Workers' Compensation will cover it?

Better do your homework:

- 65% of initial SSDI claim applications were denied in 2012.

- Can your family live on $1,130 a month? That's the average monthly benefit paid by Social Security Disability Insurance (SSDI) at the end of 2012.

- The average SSDI monthly benefit payment for males was $1,256

- The average SSDI monthly benefit payment for females was $99316

- At the end of 2012:

- 7.3% of SSDI recipients received less than $500 monthly.

- 46% received less than $1,000 per month.

- 93% received less than $2,000 per month.17

- Less than 5% of disabling accidents and illnesses are work related. The other 95% are not, meaning Workers' Compensation doesn't cover them.12

- U.S. Social Security Administration, Fact Sheet February 7, 2013

- U.S. Census Bureau, American Community Survey, 2011

- U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

- Council for Disability Awareness, Personal Disability Quotient (PDQ) calculator

- Council for Disability Awareness, Disability Divide Consumer Disability Awareness Study, 2010

- Gen Re, U.S. Group Disability Rate & Risk Management Survey 2012, based on claims closed in 2011

- Gen Re, U.S. Individual DI Risk Management Survey 2011, based on claims closed in 2010

- Commissioner’s Disability Insurance Tables A and C, assuming equal weights by gender and occupation class

- The American Journal of Medicine, June 4, 2009 Medical Bankruptcy in the United States, 2007: Results of a National Study; David U. Himmelstein, MD, Deborah Thorne, PhD, Elizabeth Warren, JD, Steffie Woolhandler, MD, MPH

- U.S. Courts, Bankruptcy Statistics, 12-Month Period Ending December 2007

- Get Sick, Get Out: The Medical Causes of Home Mortgage Foreclosures, Christopher Tarver Robertson, Richard Egelhof, & Michael Hoke; August 8, 2008

- Council for Disability Awareness, Long-Term Disability Claims Review, 2012

- U.S. Federal Reserve Board, Survey of Consumer Finances, 2010

- American Payroll Association, “Getting Paid in America” Survey, 2012

- Council for Disability Awareness, Worker Disability Planning and Preparedness Study, 2009

- U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

- U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

Disability is already widespread in the U.S. and the risk is growing. Here’s what you can do to reduce your chances of becoming disabled.

How much do you know about disability?

Test your disability awareness. Take our Quick Quiz.

Or download the CDA Disability Awareness Quick Quiz.

What are YOUR chances of not being able to earn an income?

Why is your PDQ so important? Because your income is important! How else will you afford all the things that are important to you – your home, your family's lifestyle, your children's education, your own retirement?

The likelihood of you becoming sick or injured and unable to work is higher than you probably imagined. The PDQ is an easy way to calculate your own personal odds and discover what's really at stake. Then we'll give you some tips on how you can prevent disability from downgrading your lifestyle and devastating your savings.

Download the NEW! Printable Personal Disability Quotient (PDQ) Calculator

WHAT’S YOUR PDQ?

FIND OUT NOW.

Everyone should know their chances of not being able to earn an income. That’s what your Personal Disability Quotient (PDQ) calculates—your own chance of being injured or becoming ill that could force you to miss work for an extended period of time.

Why is this number so important? Think about it. Your ability to earn an income is your most valuable resource. It’s what enables you to fund almost everything else that’s important to you . . . your home, your family’s lifestyle, your children’s education, your retirement.

Calculate your own PDQ now—and learn what’s really at stake. Then let us offer you some tips on what you can do to prevent disability from taking a financial toll on your family.

The PDQ calculator is presented by the Council for Disability Awareness (CDA), a non-profit organization committed to educating working Americans about the frequency and financial impact of disability, and the importance of planning. Click here to visit the CDA.

EMPLOYERS

EMPLOYERS