CDA 2011 Advisor Disability Awareness Study

The Disability Divide: Advisor Study

The gap between consumers’ attitudes – and advisors’ perceptions of those attitudes – about disabilities and their potential threat to their financial security.

- Duration of Disability

- Income Sources in Event of Disability

- Preparation for Disability

- Interest in Income Planning

- Conclusion

Income Sources in Event of Disability

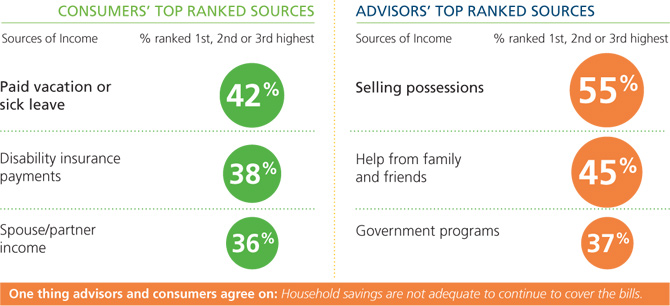

When asked what source they’d likely tap in the event they became disabled and couldn’t work, over 40% of consumers said they’d rely on employer-funded sick/vacation leave.

Advisors predict their clients would rely on completely different income sources than those actually cited. In fact, consumers’ top pick – sick pay and vacation – ranked seventh out of 10 choices on the advisors’ list.

Other perceived top sources of income include disability insurance payments, a spouse’s or partner’s income, and debt. But many of the sources cited are probably not sufficient to cover living expenses for an extended period.

Most consumers (65%) said they could not survive financially for more than one year without income.

What’s also interesting to note is that Gen Y respondents were more likely than other groups to consider tapping into their retirement savings – not likely to be a significant asset at this stage in their careers.

Interestingly, “disability insurance payments” ranked fifth on the advisors’ list versus second on the consumers’ list. Perhaps some consumers’ overestimate their coverage – others think they have coverage when they really don’t. Advisors typically recognize that many consumers’ incomes are not well enough protected, or not protected at all. Most consumers have not thought much about how they would replace their most valuable financial resource – their income, and most overestimate their ability to maintain their lifestyle for any extended period of time should they suffer an income loss.

Recognizing that income protection planning is inadequate, advisors are far more pessimistic – or perhaps realistic – about how long consumers can last without income.

Charts and graphs

Research has shown that many individuals prefer to receive information graphically rather than from numbers or written text. The charts and graphs below were derived from various sources, including CDA studies. Please feel free to download and print the charts and graphs to support your needs, and help support our mission to raise awareness of the risk of disability through education and public awareness.

Infographic: The Disability Disconnect

Download our handy infographic highlighting the risk, causes and consequences of disability, and how wage earners’ perceptions differ from the reality.

Download PDF for electronic use

Download PDF for print – letter size

Download individual chart images

2. Disability Divide: Worker Research Study

- Disability can happen at anytime (JPG | PDF)

- Percent who could pay the bills with no income (JPG | PDF)

- Percent who believe disability typically lasts “X” amount of time (duration) (JPG | PDF)

- What employees value (financial resources) (JPG | PDF)

- Where would the money comes from to pay bills if disabled? (JPG| PDF)

3. CDA Annual Long Term Disability Claims Review (2014)

This section last updated June 13, 2014

- Number of employers with LTD plans (View Chart)

- Number of employees with LTD coverage (View Chart)

- Number receiving disability payments (View Chart)

- Total disability payments (View Chart)

- Number of new disability claims approved (View Chart)

- Percent of disability claims by age (View Chart)

- Average age of new claimants (View Chart)

- Percentage of new claims by gender (View Chart)

- Percentage of claims by diagnosis (View Chart)

4. Social Security Disability Insurance (SSDI) Data

This section last updated June 13, 2014

- Average monthly SSDI benefit by gender (View Chart)

- Average monthly SSDI benefit by age (View Chart)

- Percent of covered workers by age – 10 year comparison (View Chart)

- Diagnostic causes of new SSDI awards (View Chart)

- Number of SSDI applications, number approved (View Chart)

- New SSDI awards as a percentage of applications (View Chart)

- SSDI historical payment data (View Chart)

- Fifteen year SSDI trends (View Chart)

EMPLOYERS

EMPLOYERS