CDA 2010 Consumer Disability Awareness Survey

The Disability Divide

The gap between what employees believe – and how they act – about the potential for an income – threatening disability

- Protection Against Disability

- Duration of Disability

- Preparation for Disability

- Income Sources in Event of Disability

- Conclusion

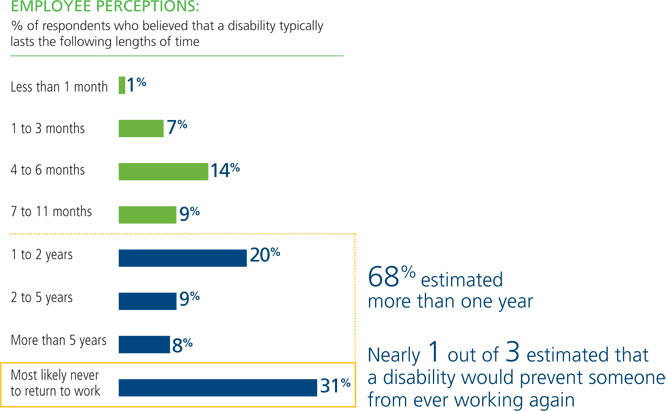

Duration of Disability

Nearly 70% of respondents think a disability would keep a person out of work for more than one year.

70% of employees in the private sector are not covered by any type of private long-term disability insurance.1

Workers surveyed believe that if a person becomes disabled, he/she will be out of work for a lengthy period of time. In fact, more than two – thirds of respondents thought that a disability would put a person out of work for a year or more. And almost one – third said that person would never return to work.

In fact, even when offered as a voluntary benefit by their employers, almost 40% of workers don’t choose long-term disability insurance.2 And barely 30% claim to understand it very well.2

Even the likelihood of receiving government benefits from the Social Security Disability Insurance program (SSDI), which could cover a person after a severe disability that is expected to last a year or more or result in death, is dwindling. Although most private sector employees are covered by SSDI, benefits are limited.

- The average monthly SSDI benefit amount in 2009 was $1,064, with 56% of recipients receiving less than $1,000 per month.3

- It is very difficult to qualify for SSDI benefits. 65% of initial benefit applications were denied in 2009,3 and the appeals process can last up to four years

- SSDI approval rates have steadily declined in recent years.4

1 Social Security Administration, Fact Sheet, Jan. 31, 2007.

2 CDA 2008 Worker Disability Planning and Preparedness

Study.

3 Social Security Administration, Disabled Worker

Beneficiary Statistics, ssa.gov.

4 The 2010 CDA Long-Term Disability Claims Survey.

Charts and graphs

Research has shown that many individuals prefer to receive information graphically rather than from numbers or written text. The charts and graphs below were derived from various sources, including CDA studies. Please feel free to download and print the charts and graphs to support your needs, and help support our mission to raise awareness of the risk of disability through education and public awareness.

Infographic: The Disability Disconnect

Download our handy infographic highlighting the risk, causes and consequences of disability, and how wage earners’ perceptions differ from the reality.

Download PDF for electronic use

Download PDF for print – letter size

Download individual chart images

1. Preparing for Disability – Protect Your Income

2. Disability Divide: Worker Research Study

- Disability can happen at anytime (JPG | PDF)

- Percent who could pay the bills with no income (JPG | PDF)

- Percent who believe disability typically lasts “X” amount of time (duration) (JPG | PDF)

- What employees value (financial resources) (JPG | PDF)

- Where would the money comes from to pay bills if disabled? (JPG| PDF)

3. CDA Annual Long Term Disability Claims Review (2014)

This section last updated June 13, 2014

- Number of employers with LTD plans (View Chart)

- Number of employees with LTD coverage (View Chart)

- Number receiving disability payments (View Chart)

- Total disability payments (View Chart)

- Number of new disability claims approved (View Chart)

- Percent of disability claims by age (View Chart)

- Average age of new claimants (View Chart)

- Percentage of new claims by gender (View Chart)

- Percentage of claims by diagnosis (View Chart)

4. Social Security Disability Insurance (SSDI) Data

This section last updated June 13, 2014

- Average monthly SSDI benefit by gender (View Chart)

- Average monthly SSDI benefit by age (View Chart)

- Percent of covered workers by age – 10 year comparison (View Chart)

- Diagnostic causes of new SSDI awards (View Chart)

- Number of SSDI applications, number approved (View Chart)

- New SSDI awards as a percentage of applications (View Chart)

- SSDI historical payment data (View Chart)

- Fifteen year SSDI trends (View Chart)

EMPLOYERS

EMPLOYERS